- A new study reveals how Americans are turning to AI for insurance.

- Younger drivers show greater trust in AI than older generations.

- Confidence in AI fades when claims and accidents come into play.

In just a few short years, artificial intelligence has shifted from an obscure technology that most people had barely heard of, let alone used, to a presence integrated into daily life, whether we like it or not.

var adpushup = window.adpushup = window.adpushup || {que:[]};

adpushup.que.push(function() {

if (adpushup.config.platform !== “DESKTOP”){

adpushup.triggerAd(“0f7e3106-c4d6-4db4-8135-c508879a76f8”);

} else {

adpushup.triggerAd(“82503191-e1d1-435a-874f-9c78a2a54a2f”);

}

});

Now, according to a new study, a growing number of Americans are apparently turning to AI to help them find the best car insurance deals.

Read: The Hidden Feature In Your Car That’s Quietly Raising Your Insurance Bill

As part of a survey of 3,002 drivers across the United States, Insurify found that 42 percent have used AI assistants to help them find car insurance.

The same study revealed that 86 percent of Americans trust AI to guide them through the process of buying coverage, suggesting a surprisingly (some might say unsettling) high level of comfort with algorithmic advice.

The technology is especially popular for comparing quotes from different insurers, with 76 percent of respondents saying they use AI for that specific task.

Unsurprisingly, younger car owners are more likely to trust AI to help them find the best insurance. Approximately 60 percent of Gen Z drivers have already turned to AI when shopping for car insurance, compared with just 20 percent of baby boomers.

That generational gap mirrors broader differences in how comfortable people feel trusting software with financial decisions.

var adpushup = window.adpushup = window.adpushup || {que:[]};

adpushup.que.push(function() {

if (adpushup.config.platform !== “DESKTOP”){

adpushup.triggerAd(“bb7964e9-07de-4b06-a83e-ead35079d53c”);

} else {

adpushup.triggerAd(“9b1169d9-7a89-4971-a77f-1397f7588751”);

}

});

The percentage of car owners using AI for insurance also varies by state, from a high of 55 percent in California to a lower 34 percent in Illinois.

AI Adoption by State

SWIPE

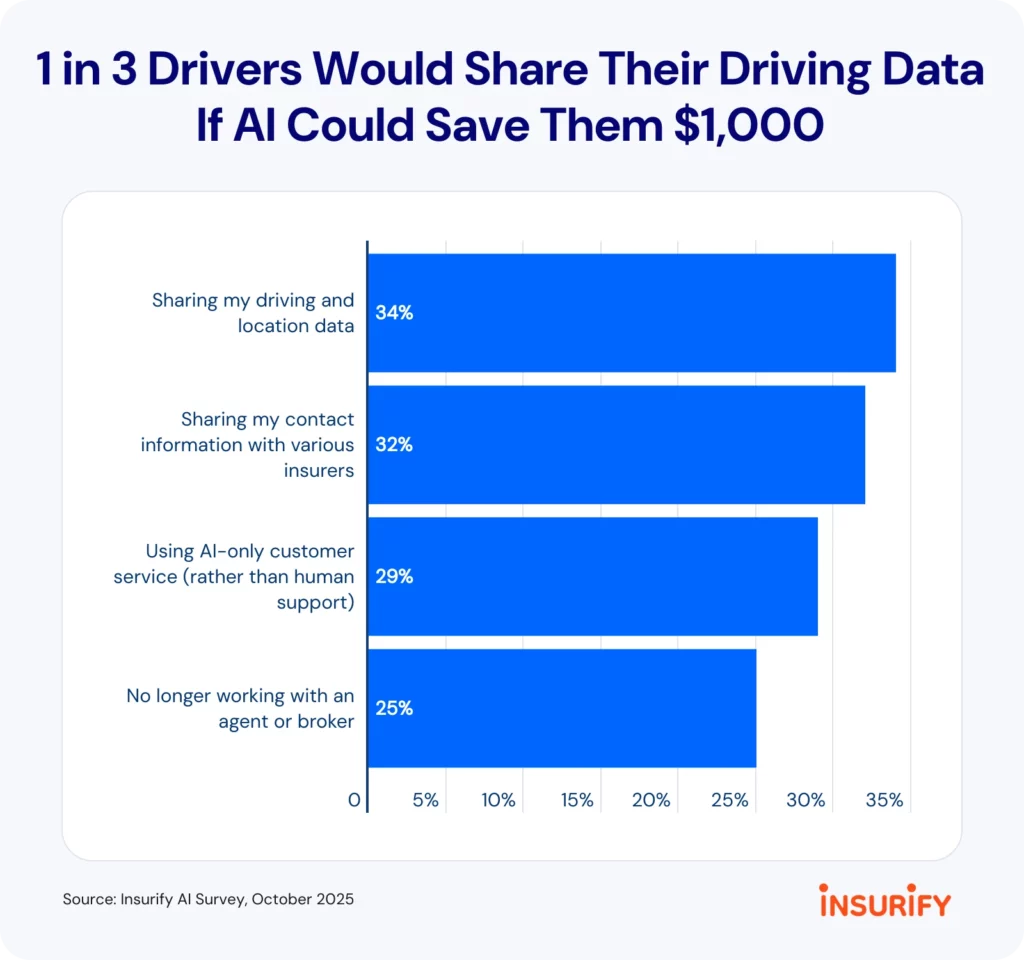

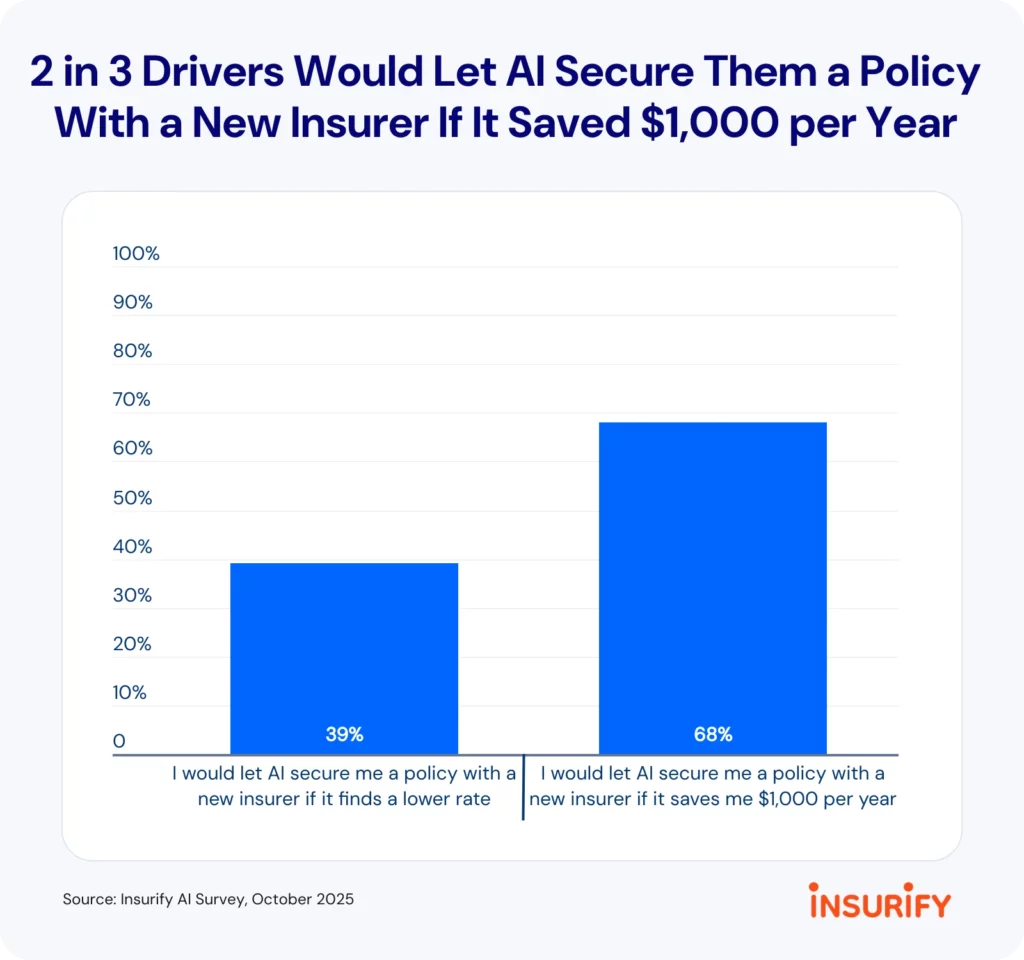

AI isn’t only useful for shopping for quotes, but also in securing a policy. According to Insurify’s data, 39 percent of drivers would allow AI to finalize their insurance if it meant finding a cheaper rate. When savings rise to $1,000, that number jumps to 68 percent, suggesting that trust grows quickly when the math favors the driver.

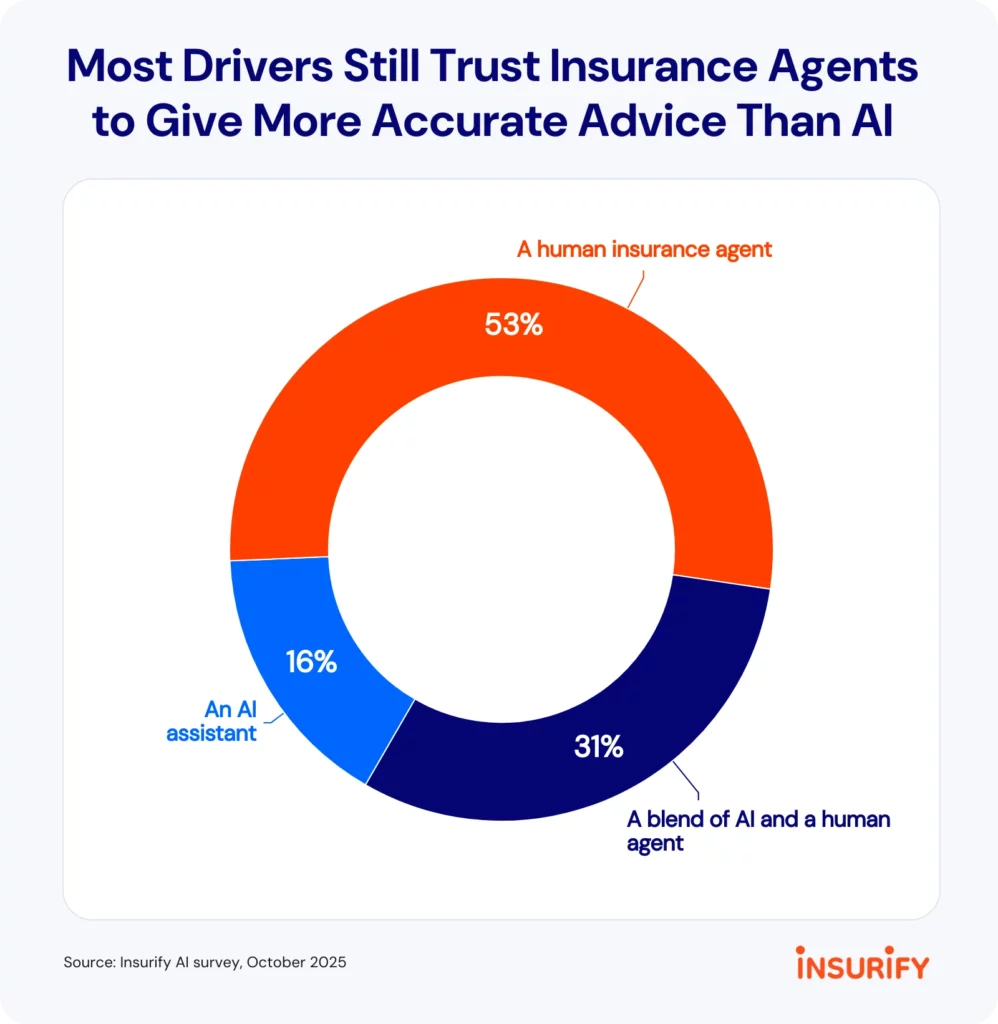

The study also discovered that 52 percent of Americans think an AI assistant can compare insurance quotes better than an agent, and 42 percent of Gen Z think it can do a better job of handling customer service than a human agent.

The Limits of Trust

var adpushup = window.adpushup = window.adpushup || {que:[]};

adpushup.que.push(function() {

if (adpushup.config.platform !== “DESKTOP”){

adpushup.triggerAd(“b25ecba7-3bbb-4ea7-a3a8-dbea91695c07”);

} else {

adpushup.triggerAd(“e46c436a-adeb-4b5e-a2c7-56bc36561c10”);

}

});

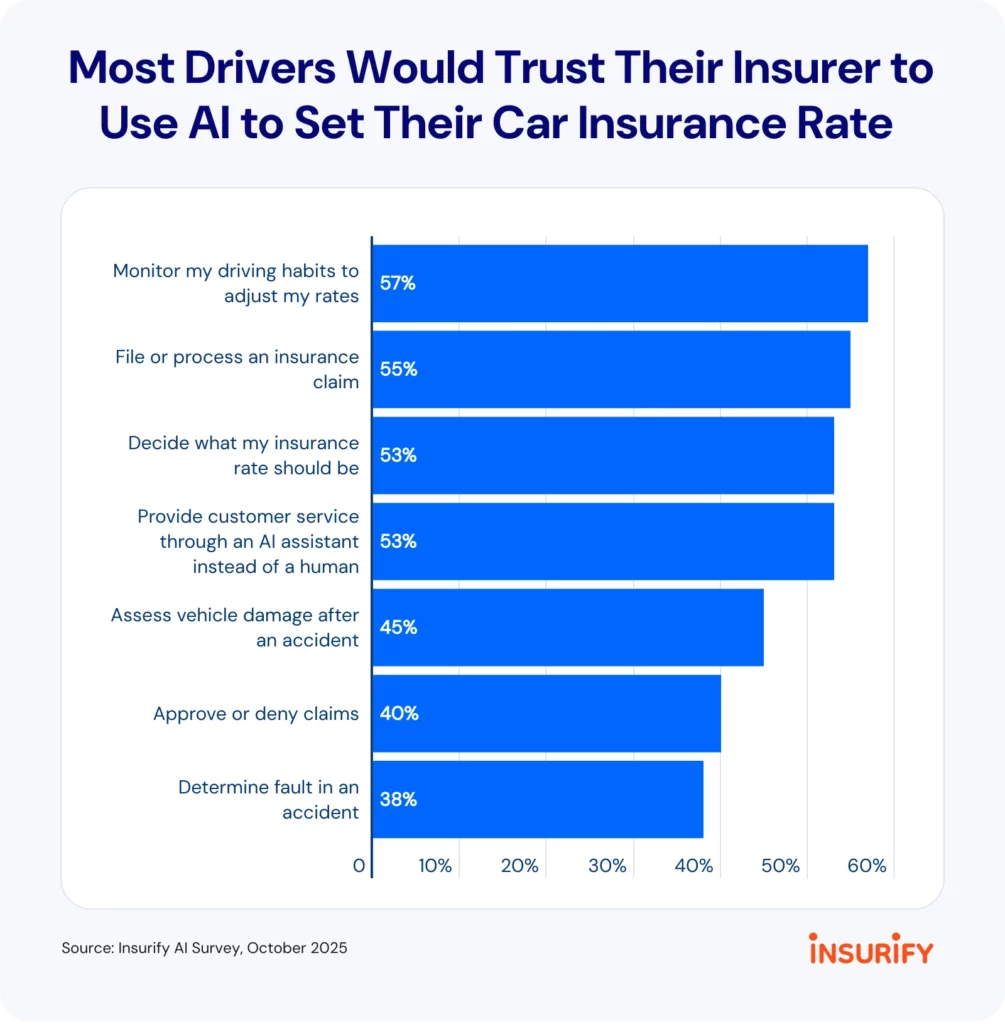

However, trust in artificial intelligence falls when it comes to approving and denying claims, as well as determining fault in an accident. The survey found that 40 percent would trust AI to approve or deny claims, while 38 percent would trust it in selecting the party at fault.

Apparently, while enthusiasm for AI-driven convenience is growing, it seems many Americans still want a human hand on the wheel when the outcome really matters.

Source: Insurify

#Surprising #Number #Americans #Buy #Car #Insurance